Summary

-

Accounting firms that embrace generative AI have the opportunity to elevate themselves into the next era of progressive, modern accounting. But knowing the pros and cons of the tool is essential to ensure proper use.

-

ChatGPT can help accountants streamline their processes and communication, but it can also produce wildly incorrect information.

-

The value of ChatGPT depends on your use case, but regardless of output, verifying and checking generated text and data is a must.

Though it has its weaknesses, ChatGPT—and other similar generative AI tools—offers a broad range of important functions that can help you be a more efficient accountant and run a more streamlined firm.

At the same time, being aware of its shortfalls is critical.

Here are the pros and cons of using ChatGPT at your practice.

The pros: How ChatGPT can enhance your accounting practices

1. It’s shifting the paradigm of how we work

ChatGPT will not steal your job. But it will automate significant parts of it. ChatGPT and GPT-powered accounting AI tools are changing the way we work—and that’s exciting!

For example, firms using Karbon AI are embedding AI into their workflows with personalized updates to their clients as jobs progress.

Leading firms who embrace and shift with the new technology will have a competitive edge, just as cloud accounting elevated modern, forward-thinking accounting firms.

2. With proper prompting, it can generate impressive outputs

The success of your experiences with ChatGPT often directly correlates to the prompt you give it. The more specific and clear it is, the more likely you are to receive a useful result.

The art of the prompt will become a thing to behold as generative AI continues to infiltrate work spaces around the world. In fact, an entirely new career path called prompt engineering is already emerging in the tech space.

Learning how to develop proper prompts to generate valuable outputs requires some practice, but once you’ve familiarized yourself with the techniques, you’ll be armed with not just multiple use cases for generative AI, but nuanced ones at that.

For example, you can prompt ChatGPT to draft an email from you based on a few bullet points. But what if you took your prompt one step further and pasted in your firm’s style guide or tone of voice guidelines directly into ChatGPT? All of a sudden, you’ve got an email draft in your firm’s brand personality.

3. It can help you get started when you feel stuck

Sometimes it’s just hard to get going. You might be stuck on a complex tax issue, finding it difficult to tweak your pricing structure, or simply stumped on what to include in your next client newsletter. Whatever the problem, chances are ChatGPT can help inject new energy into solving it.

Say you’ve come up with a new pricing structure but don’t know how to convey these changes to your clients. ChatGPT can generate a first draft of an email, giving you a starting point.

The first output probably isn’t going to get you to the finish line, but it can get you started and give you a foundation to work from.

If you’re often paralyzed when trying to write clear communication or are generally short on time, ChatGPT can do the initial lift for you.

4. It can organize and structure your data

With ChatGPT, you can extract transactions from bank statements by simply copying the text from the PDF statement, prompting ChatGPT and pasting in the text.

Once ChatGPT responds, you can copy its output and paste the data into an Excel spreadsheet.

While neither ChatGPT nor ChatGPT Plus actually enable you to upload images and PDFs (just yet), you can use a ChatGPT-inspired app to read PDFs. ChatPDF enables you to analyze information on bank statements, for example.

As long as there are no bank account numbers on what you input, you can use ChatPDF to pull and sort data from PDFs.

While the technology is still green, start with data that is easy-to-verify to ensure that your automated assistance remains accurate.

5. It can help you solve problems by doing the heavy lifting

ChatGPT can help you summarize complex tax legislation updates, for example. It’s as simple as telling ChatGPT what you want it to do, and then copying and pasting the text you want it to summarize.

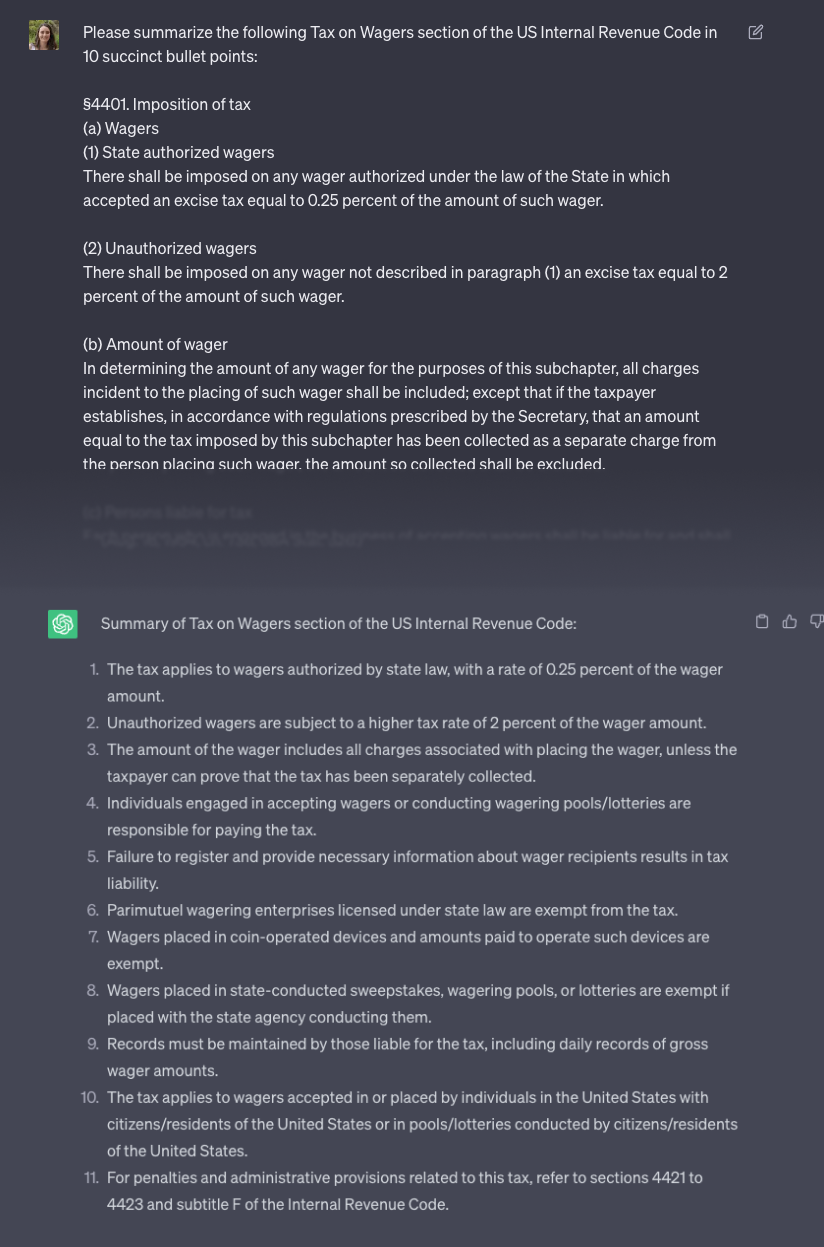

In this example, ChatGPT has been asked to summarize the ‘Tax on Wagers’ section of the US Internal Revenue Code in 10 succinct bullet points.

You can ask ChatGPT to summarize lengthy and convoluted copy, like tax codes

Recommended reading: The future of the accounting industry: 7 important trends in 2023

The cons: Why accountants should proceed with caution when using ChatGPT

1. It sounds confident (even when it shouldn’t)

AI is smart. Very smart, even. But not all the time.

You absolutely have to check its work.

ChatGPT is very confident, even when it’s wrong. This is what’s called an ‘AI hallucination’—basically, it will confidently respond with completely inaccurate information.

This is why you need to check its output every single time.

2. It’s trained on a broad range of inputs

AI is smart because of all the information its users and developers feed it. That means you have to be mindful of what you tell it.

You can use ChatGPT to help sort anonymized data from bank statements and other data sets, but be sure it’s truly anonymized. Samsung employees are banned from using ChatGPT because the company’s proprietary source code was found on the server.

ChatGPT is always listening and learning. Don’t be the reason private information gets compromised. Check your inputs before they become someone else’s outputs.

3. It’s not accounting-specific

ChatGPT may know some accounting terminology, but it’s not a CPA or an actual accountant.

When generating an email about changes to your practice for clients, for example, it will default to producing an email suited to all readers, not necessarily your clients. This is why careful prompting (and revising) is important when using artificial intelligence in accounting.

4. It’s evolving rapidly (so it can be difficult to keep up)

AI is moving—and quickly. It’s a lot to keep up with, and because the technology is constantly updating, it’s hard to remain confident in what it’s good at doing and what it isn’t good at doing.

Truly staying on top of the latest generative AI advancements requires a lot of ongoing research, which is something you might not have time for. Accounting professionals like Jason Staats are keeping their finger on the pulse, however. You can explore some of Jason’s AI-related content here.

5. It isn’t trained on up-to-date information

The demo of GPT-4 that generated tax returns left many feeling anxious. But here’s the part that is often overlooked: ChatGPT incorrectly calculated tax liability because it used tax tables that are decades old. So while it may have looked impressive, the output wasn’t totally accurate.

Be careful when assuming that generative AI knows what it’s doing. Especially with timely information, proceed with caution.

Proper use yields major potential

ChatGPT remains dependent on the user.

What you get from it depends on how you use it—and how you understand it. For those who are willing to learn how to take full advantage of the tool, the pros far outweigh the cons.

With careful, responsible use, critical thinking, a keen eye for ensuring accuracy, and a willingness to adjust outputs, generative AI tools have the potential to transform how your firm operates.

Learn more about using ChatGPT at your firm: 6 ways you can use ChatGPT as an accountant now