Summary

- Building trust is the single most important thing you can do to generate leads

- A strong online presence (including social media) will help you reach the right audiences

- Not all your lead generation efforts should be aimed at making an immediate sale—provide audiences with genuine value to help build your reputation

- Focusing on a specialized market, or niche, will help you tailor your lead generation efforts

If your firm isn’t growing at the rate you expect, even as you deliver high-quality client work day-in-day-out, it can be frustrating.

The landscape has changed from ‘do good work and the business will come’, to one centered around proactivity in lead generation. Marketing yourself is now a crucial part of operating a CPA accounting firm or bookkeeping business—you can’t just rely on word of mouth any more.

It comes down to trust. In all business, but especially in accounting, it's the most important thing you can earn.

In fact, 86% of small business owners agree that their accountant is their trusted advisor, and five out of six consider their accountant ‘a trusted advisor they can turn to for a wide range of business advice’. Finally—and most impressively—31% say their accountant is the advisor they trust the most, followed by family and friends (22%), lawyers (16%), and financial planners (9%).

Marketing, advertising, and other techniques will help you build that trust. So while networking and word-of-mouth is still important, there are many other tactics you can employ to generate potential leads for your accounting firm.

9 ways to get accounting leads that convert

Here are 9 lead generation strategies to help you attract qualified leads to your accounting practice:

Specialize your services and form a niche

Partner with other advisors and related businesses

Establish a strong online presence and website

Create a marketing plan that speaks to potential clients in your area of specialization

Provide value to prospective leads with email marketing

Reach the right audiences with digital advertising

Build trust with case studies, testimonials, and referrals

Be where the people are: Network at your audience's industry events and forums

Establish yourself on social media

1. Specialize your services and form a niche

Specializing in specific industries, or market niches, establishes you as an industry expert. And when people understand your experience is specific to their industry, they’re more likely to trust you.

For example, if your client owns a chain of childcare centers, they will have specific accounting rules that apply to them. Rules that are not applicable to another client, say, a dental surgery owner.

By forming a market niche, you showcase that you have expertise in a particular field.

Every small business is unique. While they all need accounting services, each one has its own terminology, ideas, clients, market, and way of doing business. And by specializing in these markets, you appeal to those clients looking for someone who knows their specific business needs.

Real example

Parable is an accounting firm based in the US that solely focuses on accounting, bookkeeping, and strategic services for churches. Everything they do is specific to this niche.

Parable’s website homepage

2. Create a marketing plan that speaks to potential clients in your area of specialization

It’s all well and good to have a target niche. But if you’re not talking directly to them, how will they know you’re there?

In order to reach your target audience, you need to research:

Where they are

How they talk

What they care about

What their challenges are

Where they engage

Do they attend industry events that you can also attend?

Do they subscribe to particular newsletters you can sponsor?

Your marketing plan should be completely tailored to your target audience. You need to speak their language. For example, high-end creative agencies are more likely to be receptive to creative communications that are high quality, well-designed, and thought out.

💡 Pro tip: If you’re struggling to build your content marketing strategy, consider asking ChatGPT to help you get started. It’s one of the ways you can use generative AI as an accountant to spark your creativity. To start, remember to keep your marketing efforts simple.

3. Partner with other advisors and related businesses

Working with other businesses, such as legal firms, bookkeepers, or adjacent industries and services, will help you reach a host of potential clients.

It might seem counterintuitive to partner with another firm that you would traditionally consider a competitor, but if you both specialize in different services, you can form a relationship that’s mutually beneficial.

An example of a fruitful partnership might be a partner email swap: an exercise that lets complementary firms support each other at no cost by using each other’s client base.

Both firms email their respective mailing lists with a recommendation of the other’s services. It’s especially effective because the referral is coming from someone that the clients already trust.

4. Establish a strong online presence and website

Every accounting firm needs a complete, modern online presence. That doesn’t mean you need to have a TikTok (although there are arguments for that, too), but it does mean you need to have a functional website that shows clients who you are, what you offer, and why they should sign with you.

Although you might get a more custom website if you hire a web developer, you have cheaper DIY options. There are many low-cost website building services such as SquareSpace or Wix that allow you to create professional websites without having deep technical expertise.

In a world where technology is so central to business, clients will judge your website as a representation of you. 97% of people looking for local services looked online first—so, if you’re poorly represented there, it will hurt your ability to acquire new leads.

There are no excuses for not having a working, attractive website in 2023.

But it goes beyond that. Your website needs to be discoverable in the first place. Google services over 4 billion users every day, with 100,000 searches per second. That’s where Search Engine Optimization comes in.

Every search resulting in your firm’s website being accessed, or an article you wrote being read, is another opportunity to bring in a new client. So you need to ensure your website’s SEO and local SEO are competitive.

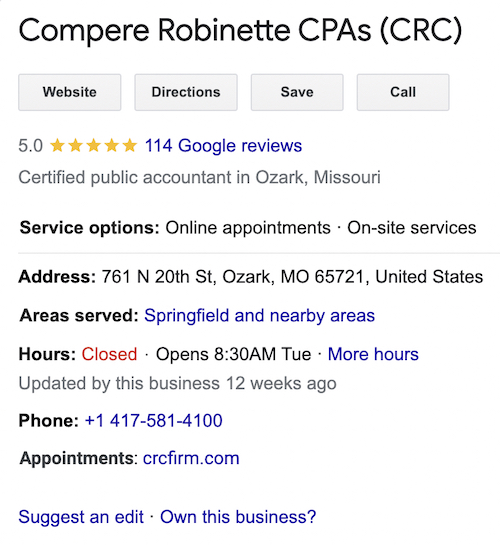

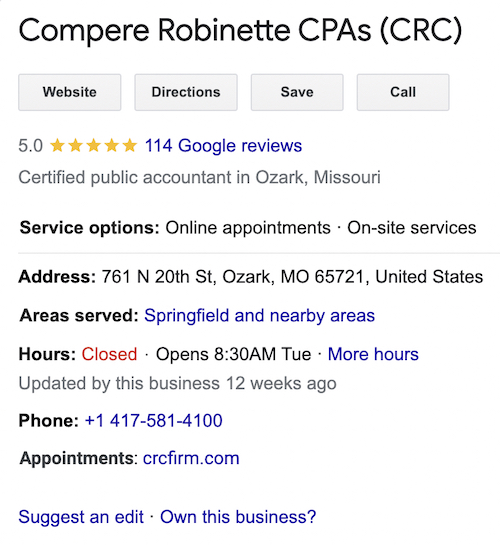

Real example

Compere Robinette CPAs (CRC) is an accounting firm based out of Ozark, Missouri. Their Google Business Profile is a great example for accounting firms. It includes clear and useful information, including the firm name, location, open hours, service options, etc.

CRC’s local SEO profile is a great example for accounting firms

This kind of information is exactly what a prospective client needs to take the next step and make contact.

5. Provide value to prospective leads with email marketing

Email marketing has a 2x higher return on investment (ROI) than cold calling, networking, or trade shows.

And with the average professional receiving approximately 120 emails per day, email inboxes are competitive arenas. This makes it a fine line to walk—you don’t want to annoy and spam prospective leads but you also want to be top of mind when it comes to their accounting and advisory needs.

And you don’t need to be selling all the time. Content marketing is a less aggressive but effective way to generate leads. By producing content that is genuinely aimed at providing value to your audience, you accomplish two things:

You position your firm as experts and thought leaders in your target industry.

You demonstrate that you’re interested in their business’ success, and aren’t focused on just selling them something.

Both of these outcomes also contribute to the single most important factor in securing someone’s business: trust.

💡 Pro tip: Including the recipient’s name in the subject line (something that can be easily automated with the right marketing automation and CRM software) boosts email open rates by 29.3%.

Real example

A great example of this is Karbon’s Practice Excellence Weekly newsletter. Its sole purpose is to provide accounting leaders with content that will help them be more confident leaders, lead stronger teams and run more profitable firms.

It’s designed to provide value to accountants, and in doing so, builds trust. If the time comes that a reader is looking for a practice management solution for their firm, hopefully Karbon will be one of the first solutions they think of.

6. Reach the right audiences with digital advertising

When people are searching for solutions on the internet, it's crucial that you're readily available and positioned in front of them. And one effective way is through paid ads.

Facebook Ads, LinkedIn Ads and Google Ads can be expensive, but they offer a powerful way to reach the right audience at the right time. Their sophisticated algorithms and advanced audience filters mean you can pinpoint your target audience with a high degree of accuracy.

You can narrow down on who your ads are served to, helping you to ensure you’re talking to the right people. This, in turn, ensures you receive a better return on your ad spend (ROAs).

If you’re unfamiliar with paid advertising but want to learn more about it, you can take a free course on Google Ads, or engage a marketing professional for advice before you get started.

7. Build trust with case studies, testimonials, and referrals

People trust the opinions of those who don’t have a horse in the race. It’s one thing to say, ‘I’m trustworthy and provide good services’, but if someone who stands to gain nothing says it, it’s going to carry more weight.

All that to say: recommendations from people that clients know are two times more likely to generate action.

Some referrals will happen organically, but with a little extra effort on your part, they can become a major source of quality accounting leads.

You might feel a little awkward asking for a referral, but if you’re delivering good work for a client, they’ll be happy to pass on your information to a peer. As best selling author, Dale Carnegie, said: 91% of customers say they’d give referrals, but only 11% of salespeople ask for referrals.

Case studies, too, while less targeted and more general, have the same effect. They offer social proof, showcasing high-quality work and demonstrating reliability. Writing about the successes of your clients can motivate them to share these stories broadly through their own channels. That markets you to an entirely new audience—all without appearing insistent.

8. Be where the people are: Network at your audience's industry events and forums

Going to industry events (or online meet-ups) is a great way to generate new leads. You’ll be more informed on industry trends, common client pain-points and tech developments. It will be easier to effectively market your services and target the right clients.

Not to mention that you’ll be in the same room as them, giving you a solid chance to create valuable connections.

Real example

Justin Mastores, Managing Partner at Australian accounting firm Rees Group, hosts annual Property Briefing breakfast events and invites other professional services leaders to make presentations.

By combining forces with the networks of investment groups, mortgage brokers, and other professional services businesses, Justin is expanding his firm’s reach, all while providing genuinely valuable content and insights.

9. Build a social media presence

More than half of the world now uses social media (60%)—that’s 4.8 billion people. And they’re spending, on average, 2 hours and 24 minutes on social media each day.

But does it really matter to your firm?

Well, 71% of consumers who have had a positive experience with a brand on social media are likely to recommend the brand to their friends and family.

Taking that into account, social media matters to your accounting firm, particularly when trying to generate new leads.

#TaxTwitter is a popular community on X (formerly known as Twitter) where accounting professionals from around the world share knowledge, tips, advice, and help each other find business.

5 tips to convert leads more efficiently

It’s one thing to garner more accounting and bookkeeping leads, but to convert them into clients is arguably even more important.

1. Be available and proactive

Sometimes, slow and steady doesn’t win the race. When it comes to closing deals, replying to inquiries as quickly as possible ensures you’re capitalizing on what may be someone's ideal time to buy.

Clients want accountants who are proactive, so strike while the iron is hot

2. Make sure your website is the best representation of your firm

Your website is an extension of your firm and a huge part of your digital marketing strategy.

Progressive accounting clients are looking for progressive firms. And if your website doesn’t indicate that you’re a modern firm, potential clients will move on in their search.

Having key messaging and basic information about your firm clearly displayed on your website and landing pages will help convert leads. Potential clients should be able to see what you’re about, and your website should have a clear call to action (CTA) for them to take next steps.

Here are 5 messages that your firm needs to communicate to put your best foot forward when converting leads to new business.

3. Follow up (and fast)

On average, only 2% of sales are made on the first point of contact. And the remaining 98%? They're the result of continued communication, follow-ups, and outreach efforts.

And it doesn’t stop at just one follow-up email. In fact, the conversion statistics don’t get much better across the second, third or even fourth contact. It’s only between the fifth and twelfth contact that a massive 80% of sales are made.

Following up isn’t a luxury—it’s a necessity.

Adding value with each follow-up is a great way to keep leads engaged. Send them useful information, and share advice or news relevant to them. It will build trust and your reputation while moving them along the path towards a closed deal.

4. Systematize your sales funnel and pipeline

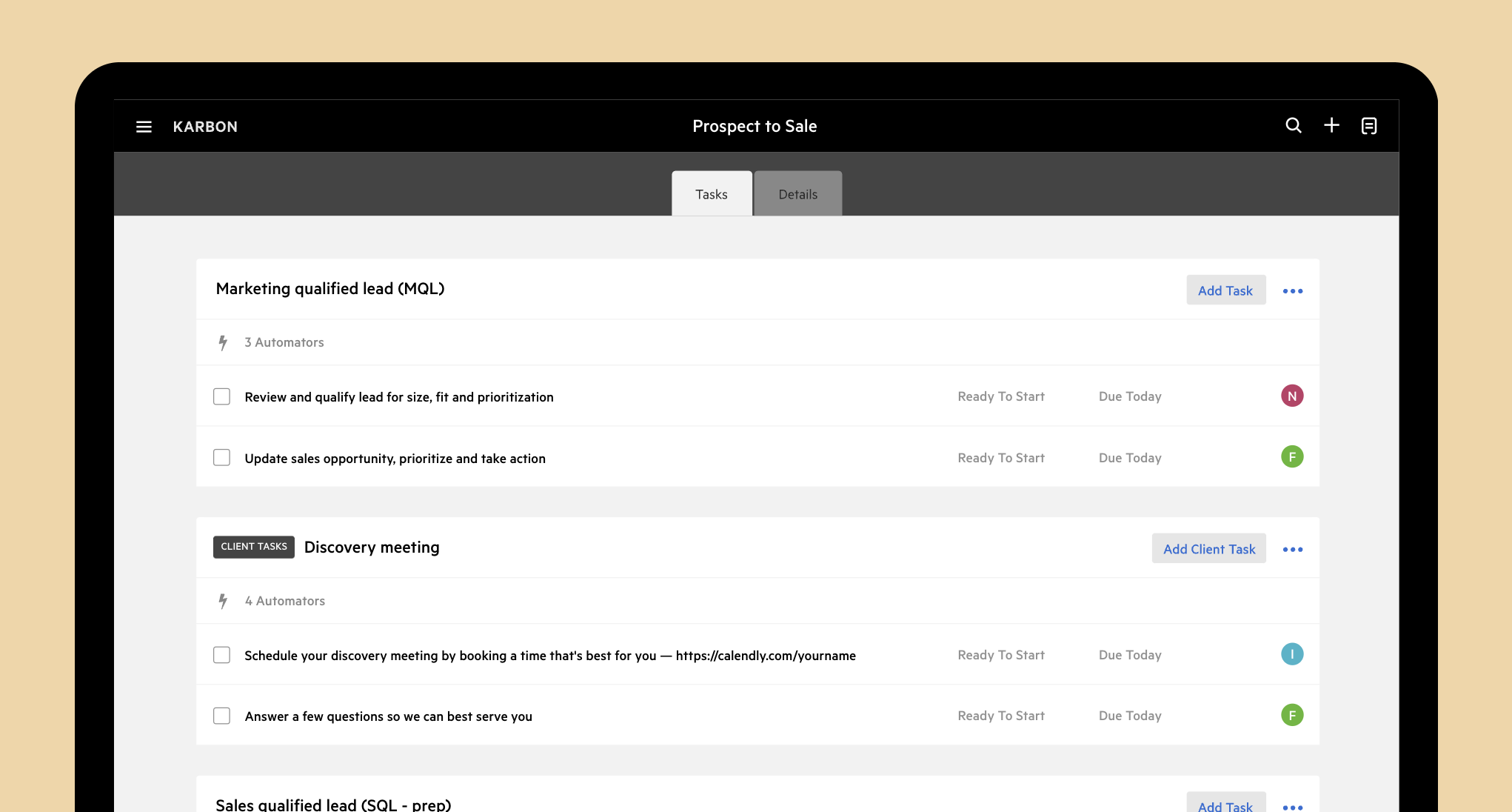

When your sales process is consistent, standardized, and documented, you’re already one step closer to converting leads. This is because you’ll be more effective and efficient in closing deals, giving you the opportunity to employ automation, templates, and technology to further scale your sales process.

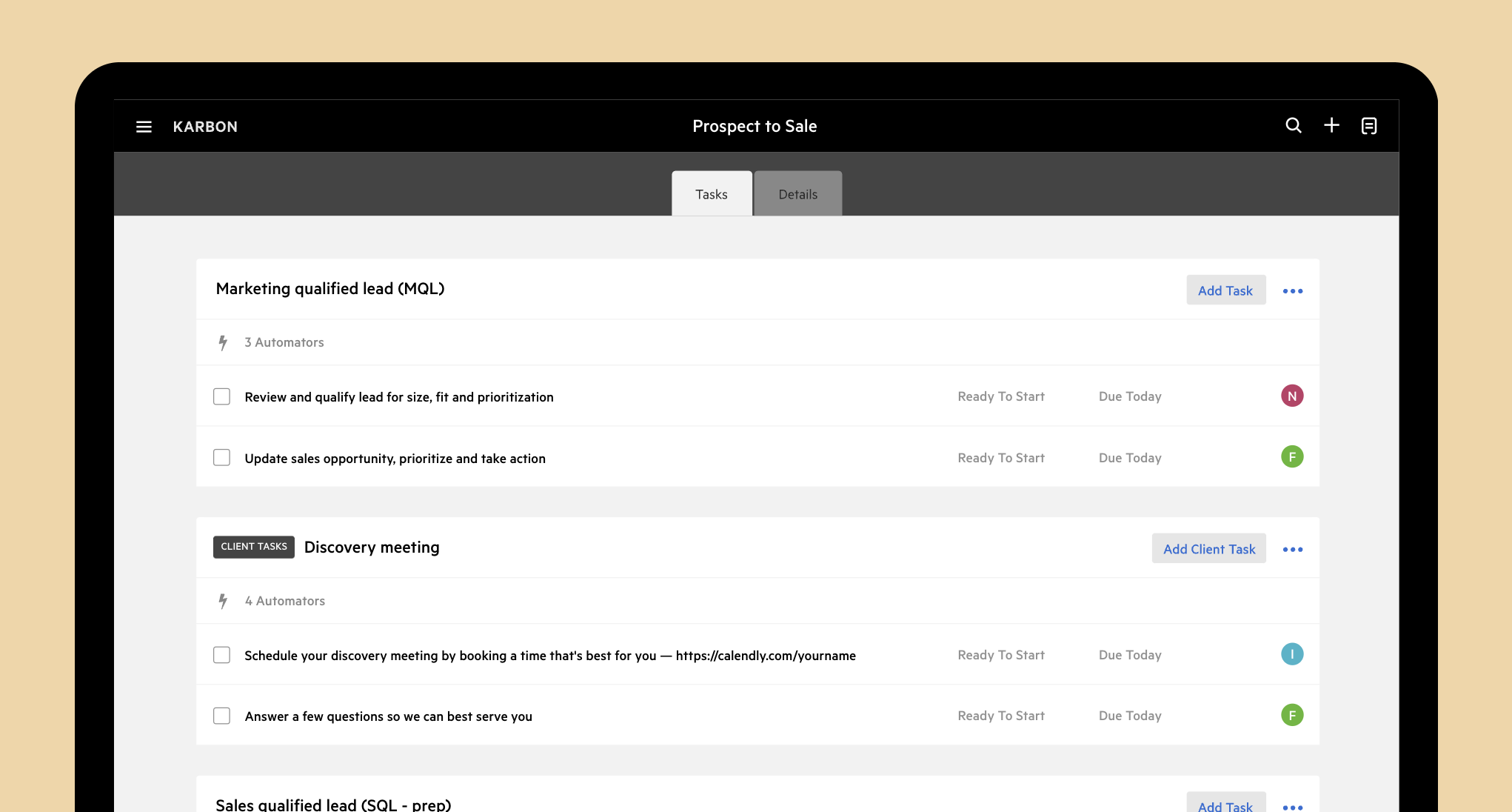

If you use a practice management system like Karbon to run your firm, you can use pre-built sales management templates like the Prospect to Sale template to manage every step that turns a prospect into a client.

The Prospect to Sale template outlines an easy-to-replicate process to turn a prospect into a sale.

Download the Prospect to Sale template.

5. Make things easy for leads: Reduce the fields on sign-up forms

The fewer steps a lead has to take to become a client, the better. Work out the minimum information you need to qualify them as a lead (minus their contact information) and only ask for that information.

For example, you may only need to know a prospect’s annual revenue to understand whether or not they’re a potential fit for your firm. So along with their name and email address (so you know who they are and how to reach them), consider only asking for their typical annual revenue.

This means removing all other fields in your inquiry form—e.g. phone number, location, and industry. In doing so, you:

Simplify the process

Remove barriers blocking them from becoming a lead

Harness technology to generate more leads

Finding more leads for your firm isn’t as simple now as it was 20 years ago. In the digital age, clients won’t materialize just because their business is down the road.

But there are more opportunities to reach them.

Email marketing, the internet, and social media are transformational avenues to capitalize on. And employing the right technology will help you become more efficient and effective at generating accounting leads for your firm.

But remember that the single element that underscores each of your efforts is trust. Potential clients need to trust you, your expertise, and your experience. So ensure your efforts are authentic.